GST TDS

By CA Pooja Jain | Dated: 03 September 2025

🔹 What is TDS under GST

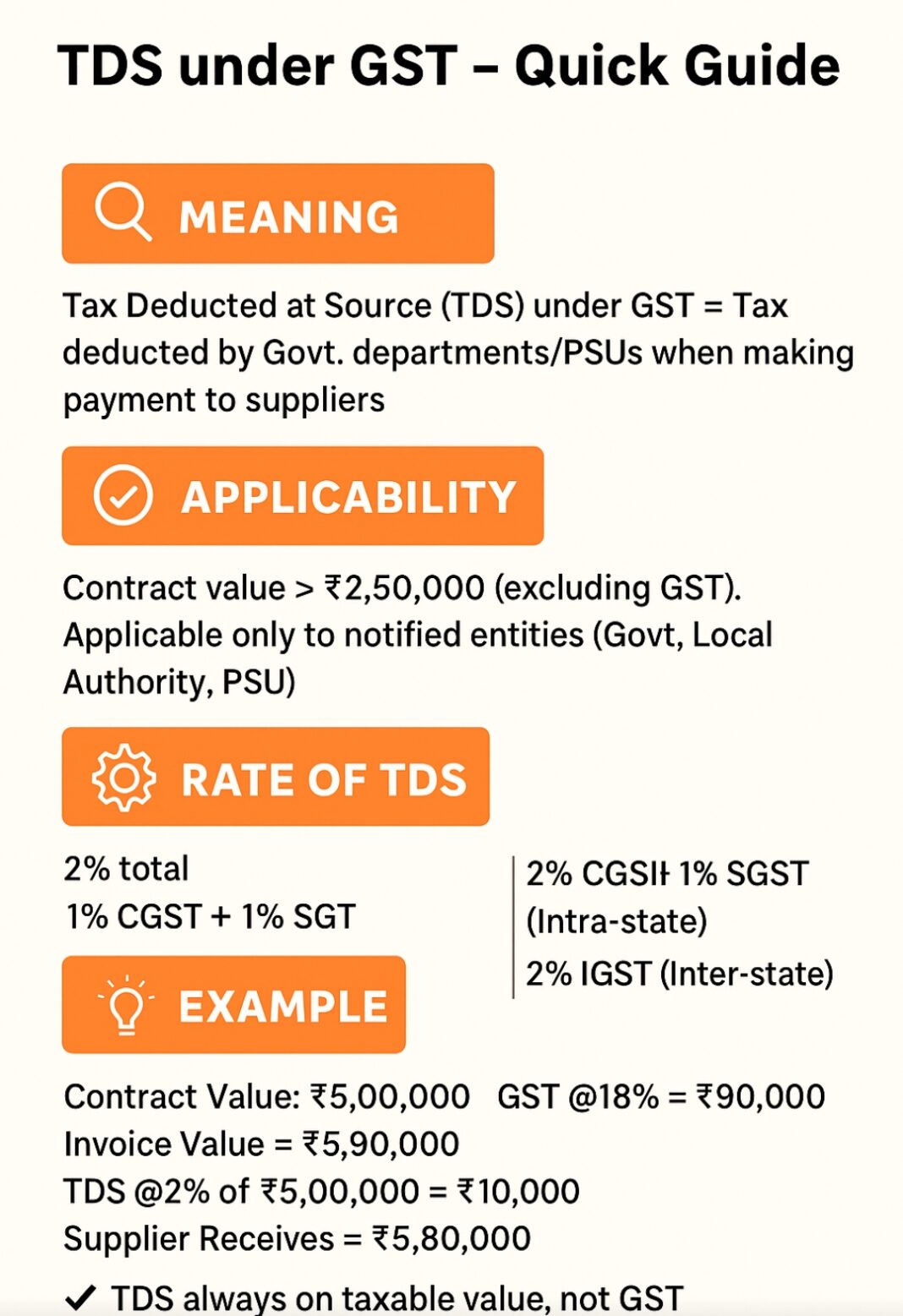

Tax Deducted at Source (TDS) under GST is a mechanism introduced to ensure smooth tax collection and better compliance. Under this system, when certain notified persons (such as Government departments, local authorities, or public sector undertakings) make payments to suppliers, they are required to deduct a small portion of tax from the payment and deposit it with the Government.

This deducted amount is later available to the supplier as a credit in their electronic cash ledger, which can be used for payment of GST liabilities.

—

Latest Update (September 2025)

The Goods and Services Tax Network (GSTN) has introduced invoice-wise reporting functionality in Form GSTR-7.

Advisory No. 626 dated 26th September 2025 announced the rollout of this feature.

Vide Notification No. 09/2025 – Central Tax dated 11th February 2025, GSTR-7 was amended to capture invoice-level details of tax deducted at source (TDS).

This functionality is now live on the GSTN portal.

From the September 2025 tax period onwards, all deductors must report invoice-wise TDS details in GSTR-7.

The due date for September return filing is 10th October 2025.

👉 All TDS deductors are advised to prepare invoice-level data while filing GSTR-7.

🔹 When Does TDS Apply?

TDS provisions are not applicable to every transaction. They come into play only when:

The contract value of supply of goods or services exceeds ₹2,50,000 (excluding GST).

The recipient is a notified deductor such as a Government department, local authority, or PSU.

The place of supply and registration of supplier/recipient determines whether TDS is deducted as CGST + SGST (intra-state) or IGST (inter-state).

TDS Rate under GST

2% in total

1% CGST + 1% SGST (intra-state supply)

2% IGST (inter-state supply)—

🔹 Practical Example

Let us assume a Public Sector Undertaking awards a contract:

Contract Value (excluding GST): ₹5,00,000

GST @18%: ₹90,000

Total Invoice Value: ₹5,90,000

TDS Calculation

TDS = 2% of ₹5,00,000 = ₹10,000

Amount paid to supplier = ₹5,90,000 – ₹10,000 = ₹5,80,000

Deducted amount ₹10,000 is deposited with the Government and reflects in supplier’s GST cash ledger.

Important Points to Note

1. TDS is always calculated on the taxable value, not on GST.

2. The deducted amount is available as credit to the supplier.

3. If TDS is not deducted or not deposited on time, it may attract interest and penalty.

4. TDS applies only to notified entities, not to all businesses.—

🔹 Why TDS Matters in GST

Helps the Government track transactions more effectively.

Improves compliance and reduces chances of tax evasion.

Assures suppliers that deducted tax is credited to their account for future adjustment.

🔹 Conclusion

TDS under GST is an important compliance requirement for Government bodies and notified entities. Suppliers working with such organizations must be aware of these provisions to avoid disputes and ensure timely availability of credit.

👉 For businesses dealing with Government contracts, maintaining proper records of TDS deductions is essential.

📌 Reference

Section 51, CGST Act, 2017

📢 Call to Action

✅ Stay updated with simplified GST guides, rulings, and compliance tips.