🚘 GST Applicability on Sale of Used Cars

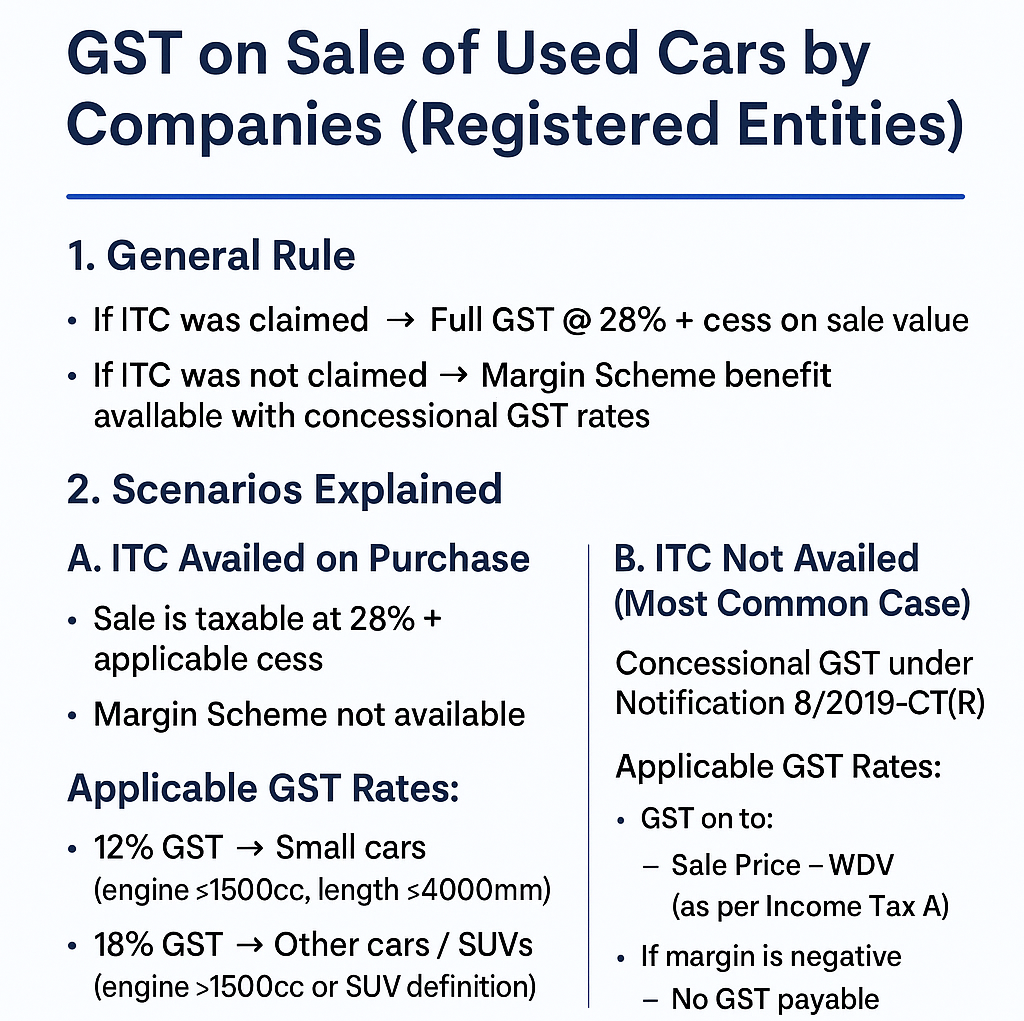

When a company sells its used car, GST treatment depends on whether Input Tax Credit (ITC) was claimed at the time of purchase.

If ITC was claimed → Full GST @ 28% + cess on sale value.

If ITC was not claimed → Margin Scheme benefit available with concessional GST rates.

—

📖 Legal Provisions

Section 7, CGST Act – Sale of motor vehicle is a supply.

Section 17(5), CGST Act – ITC on cars blocked (unless used for transport/training/sale).

Section 15, CGST Act – Valuation of supply.

Notification 1/2017-CT(R) – Regular GST rates (28% + cess).

Notification 8/2018-CT(R) – Concessional GST rates & Margin Scheme for old cars (when ITC not availed).

Notification 1/2017-CT(R) – Regular GST rates (28% + cess).

Notification 8/2018-CT(R) – Concessional GST rates & Margin Scheme for old cars (when ITC not availed).

Two Scenarios Explained

1. ITC Availed on Purchase

Sale is taxable at 28% + applicable cess.

Margin Scheme not available.

2. ITC Not Availed (Most Common Case)

Concessional GST under Notification 8/2018-CT(R).

Margin Scheme applicable.

✅ GST Rates (from 25.01.2018)

12% GST → Small cars (engine ≤1500cc, length ≤4000mm)

18% GST → Other cars / SUVs (engine >1500cc or SUV definition)

✅ Valuation (Margin Scheme)

GST on: Sale Price – WDV (as per Income Tax Act)

If margin is negative → No GST payable

Example Calculation

Car purchased in 2020 for ₹10,00,000 (no ITC claimed)

WDV (as on Aug 2025) = ₹2,00,000

Sale Price = ₹3,00,000

👉 Margin = ₹1,00,000 (3,00,000 – 2,00,000)

👉 GST @ 18% = ₹18,000

If sold at ₹1,50,000 → Margin = –₹50,000 → No GST payable

Frequently Asked Questions

Q1. Is GST applicable on sale of used cars by companies?

Yes. GST is applicable if the seller is a registered entity.

Q2. What if ITC was not claimed?

Concessional GST rates (12% / 18%) under the Margin Scheme apply.

Q3. What if the margin is negative?

No GST is payable when sale price < WDV.

Q4. Do individuals selling personal cars pay GST?

No. GST applies only to sales by registered persons in course of business.

—

⚠️ Disclaimer

This article is for informational purposes only and should not be treated as professional tax or legal advice. Please consult a qualified tax professional for guidance specific to your business.